Anxiety comes from fear of the unknown…

The biggest problem that people have with paid ads?

Its not worrying if they’re set it up correctly

Oh no, that would be far too easy…

The thing that’ll keep you awake at night?

It’s knowing if your new ad is making you money, or losing it

Its enough to freak anyone out, and so that’s why we’re going to solve first

If your serious about driving profitable traffic to your content, then you need to be a little bit nerdy

You have to do the math upfront

Why?

Because if you know your ‘numbers’, aka your ‘ROAS’ then you can know without a shadow of a doubt, if an ad is making or losing money

No more hoping and praying

(No more turning off ads that are actually making sales either)

In this chapter we’re going to walk you through step-by-step, how to find your marketing ‘goal posts’

This way you’ll know exactly what a customer is worth, how much you can afford to spend to acquire them

(And even if its feasible for you to run paid ads)

Keep reading to learn how…

|

|

|---|---|

|

|

|

|

|

|

So What Is ‘Return On Ad Spend’? (ROAS)

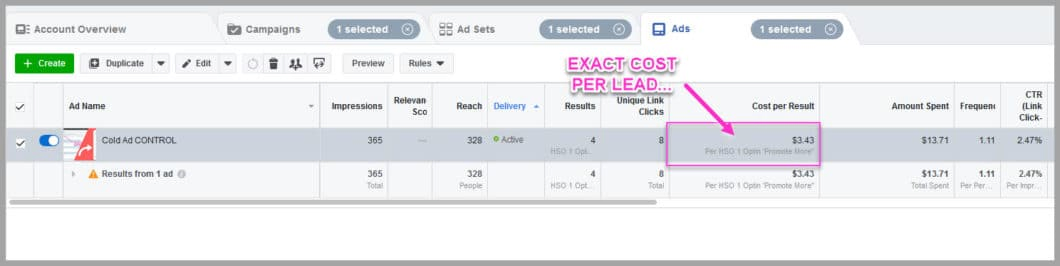

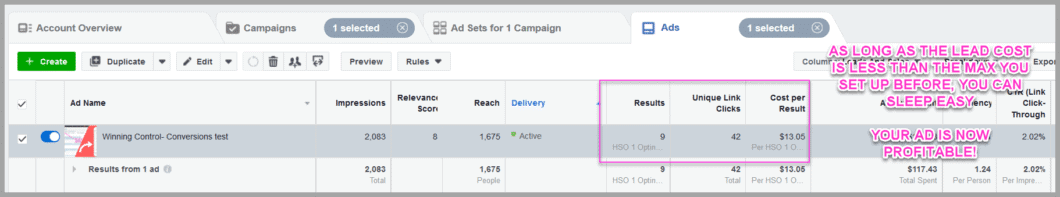

Back in Chapter 1, we shared how much new leads were costing our business

We also mentioned that this is around 5x less than what we can actually afford to spend to get a new customer…

Knowing these 2 numbers helps us sleep easy at night

Why?

Because as long as the cost to acquire a new customer is below the budget that we’ve allocated, then the ad is profitable

(We call this ROAS or ‘Return On Ad Spend’)

Simple right?

In this chapter, we’re going to help you find out this information for your own business

I know, I know…

No one enjoys math right?

But if you start here I promise you 2 things

Thing #1: You’ll know down to the dollar, if your ad is working

Thing #2: You’ll sleep far easier at night

Not a bad deal right?

Even better?

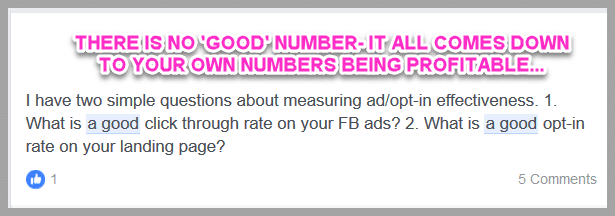

You won’t have to ask any more questions like “Is my lead cost is good’, ‘What’s a good CTR? or “How much should I spend on Facebook ads?’…

Why?

Because you’ll know the answers to those questions, uniquely for your business

The best part?

You don’t even need to be some math genius to figure this out…

The 3-Steps To The ‘Value, Budget, Conversion’ Process To Know if Your Ad Is Making Money

There are just 3 simple steps to this process

Step #1: Find out how much a new customer is worth to your business (CLV)

Step #2: Find out how much you can afford to spend to get that new customer, at a profit (CAC)

Step #3: Narrow down your tracking time…

Simple right?

You figure out the value of a new customer (Minus expenses)

You then set a budget based on that number

Then you figure out how many leads you need to convert, before you make a sale

This then gives you a max cost per lead

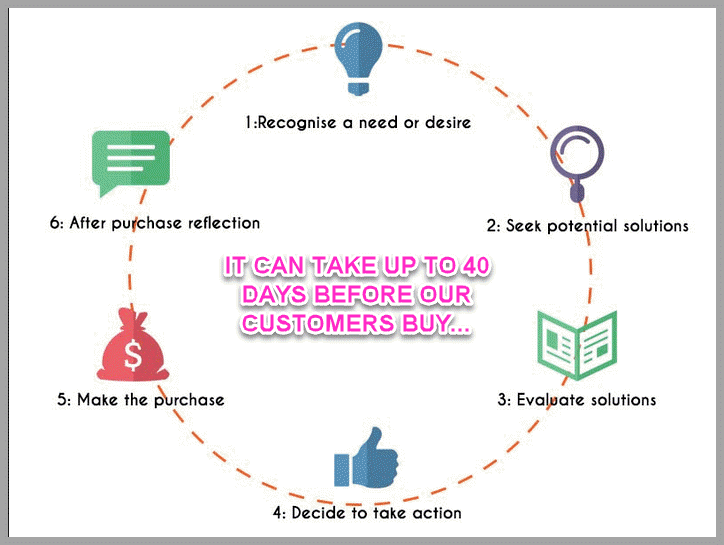

Why care about leads?

Because not everyone buys from you right away

(In our business, it can take up to 30 days to see a sale from our traffic)

This is not comforting when running a new advert

For peace of mind, you want to be able to measure your results much quicker

You need to be able to set up a new advert, and see how its performing within a few days, not months!

That’s why we care about lead cost

A new advert will show how much leads are costing you within 24 hours

And so if you know the max that you can spend per lead?

Then you can start measuring how effective your ads are almost immediately…

Step #1: How Much Is A Customer Worth To Your Business?

So here’s what you’re going to do

- Find your average order value for a new customer

- Deduct expenses and profit margin

- Find the lifetime value of a customer

This will then give you an accurate number of how much a customer is worth

(We can then use that in step 2, to figure out your marketing budget)

Its all really easy to do..

Calculate the Average Sale (Before Expenses)

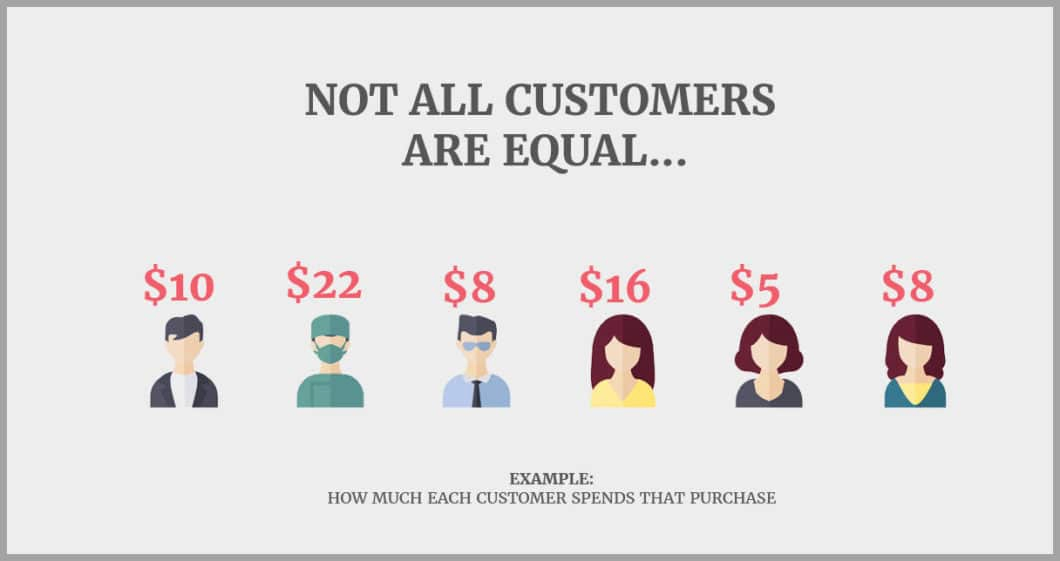

So not everyone in your business is equal

Some customers will buy more than others…

Some spend less, some spend far more

What you need to find is an average sale number

Its an approximation that represents the average purchase price of your customers

Its a really easy calculation:

total sales ($) / total orders = average sale ($)…

Simple right?

This gives you a rough idea of how much a new customer will spend with you

For Example:

Lets say that you made $23,000 in sales

You did this with 113 sales in total

We know that some spent more than others, and that’s fine

But you can use this information to figure out how much each customer spends on average

The formula is:

Total sales/ Number of sales = average sale value

So…

$23,000/113 sales = an AVG SALE (Before expenses) of $203.54

Easy right?

This now gives you a rough number to work with, which is all we care about

Now like most things, you can make it more complex than it needs to be…

Don’t worry about going too crazy with this

Use whatever information you have available

The key takeaway?

All you need to know is what a customer spends on average

This way you can then figure out what you can afford to spend to acquire a new customer

Does that make sense?

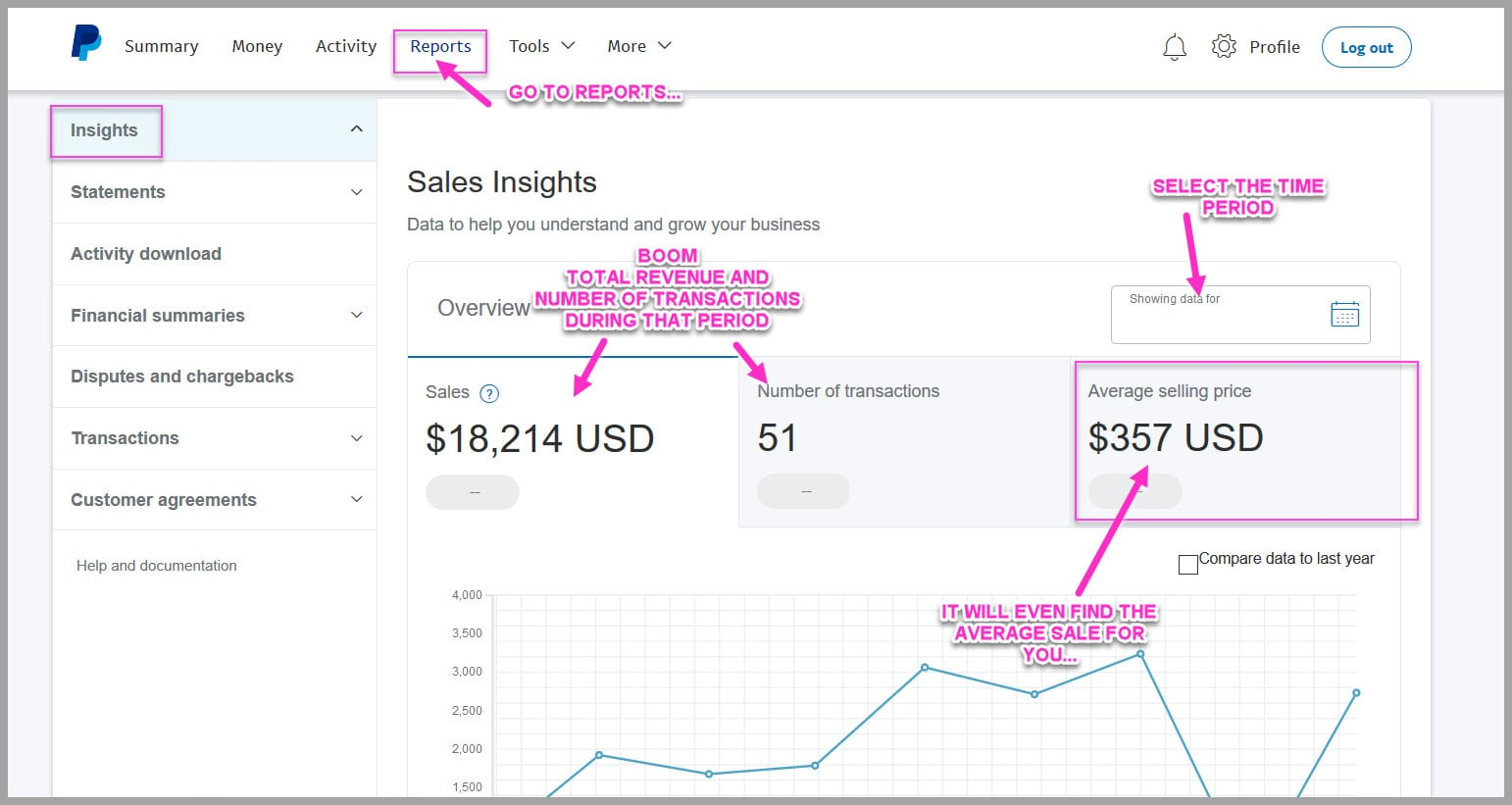

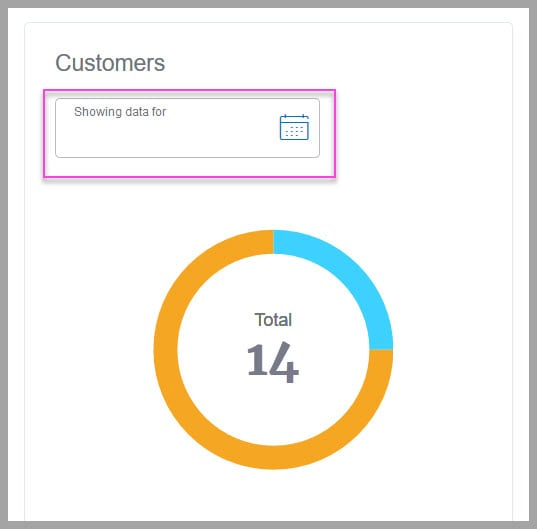

Most payment processors will show you this information right away…

For Example:

If you’re using Paypal simply

- Go to reports

- Set the time period

And it’ll show you the average sale, along with the total sales ($) and total orders during that period

Easy right?

Almost all payment processors will do this, so the math is super simple

(If not already solved for you)

Once you’ve found the average sale, you need to go deeper…

Deduct The Expenses

No product is 100% profit right?

You usually have:

- Refunds (Usually around 10%)

- Product Costs (What it costs to make)

- Labor Cost (How much your staff costs)

- Desired Profit Margin (How much profit you ideally want to make per sale)

Right now your ‘Average Sale’ is not quite accurate

You need to deduct these expenses, to find the actual value

This will then give you a more accurate idea of what a customer is worth to your business

All you need to do?

Its a simple formula

Average Sale – [Refund cost + Product Cost + Labor Cost + Desired Profit Margin]

Now I can’t show you how to find these numbers, because I don’t know what software you are using

You need to find these numbers from your own data

But so you can see how this works, let me break down my own business numbers…

Example

In my business I have an product with average sale of $237

I also know that:

- Refunds are around 5% of total sales

- Product Costs are ZERO (We have a digital product)

- Labor Cost is very high at around 30%

- Desired Profit Margin is 20%

Knowing this, I can actually find a more accurate Average Sale value

- Refunds at 5% of $237 = $11.85

- Product Costs at 0 = $0

- Labor Cost at 30% = $71.10

- Profit Margin at 20% = $47.4

This means that my average sale value is actually

$237 – [ $11.85 + $71.10 + $47.40] = $130.45

Its super important to do this

By deducting these expenses, you can make sure that you have ad ‘goal posts’

This gives you a target to aim for, while also allowing you enough margin to actually pay your bills!

(So many people forget to include these costs in their ad budgeting!)

So now you know how much a customer is worth on their first purchase, minus your expenses

Most people never get this far so great work

You’re one step closer to knowing how much you can afford to spend to acquire a customer…

Calculate the ‘Customer Lifetime Value’

Now that first sale is important, but its not an accurate representation of what a customer is worth to your business

Why?

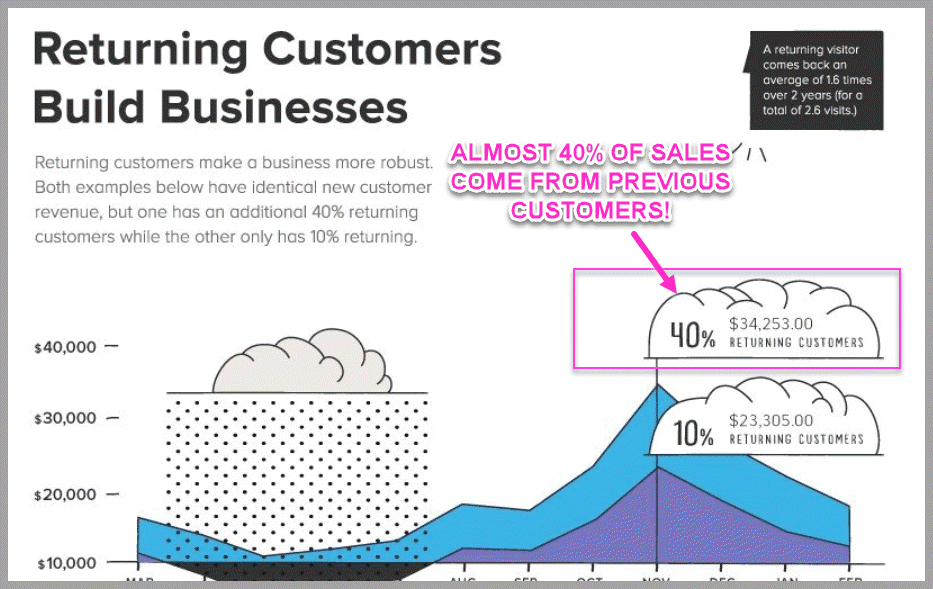

Because most customers will buy from you again and again

(Around 40% of your sales will come from repeat customers)

Right now you’re trying to figure out how much a customer is worth right?

(This way you can know how much you can afford to spend on a customer)

And so that first sale isn’t accurate enough-…

…you need to look long term instead

You need to figure out the Lifetime Value of each Customer…

For Example

Lets say that you own a surf shop and a customer buys surf wax for $4 a time

Does that mean the customer is only worth $4 to you?

Not at all

Why?

Because that customer will probably buy 5 surfboards over their lifetime with you, at $1200 each…

$4 vs $5,000

That customer is worth FAR MORE over their lifetime, than just the original purchase right?

Its super important to take that into consideration when planning your marketing budget

Why?

Because when you understand how much a customer will spend over their lifetime, you get a more accurate idea of how much they are worth

It’s quite easy to figure out…

Its the AVG SALE (After expenses), multiplied by the frequency of how many times they buy from you over their lifetime

We already have the average sale number, so we just need to find the frequency…

i.e How often do they buy, and for how long?

- Once a month?

- Once a day?

- Once a year?

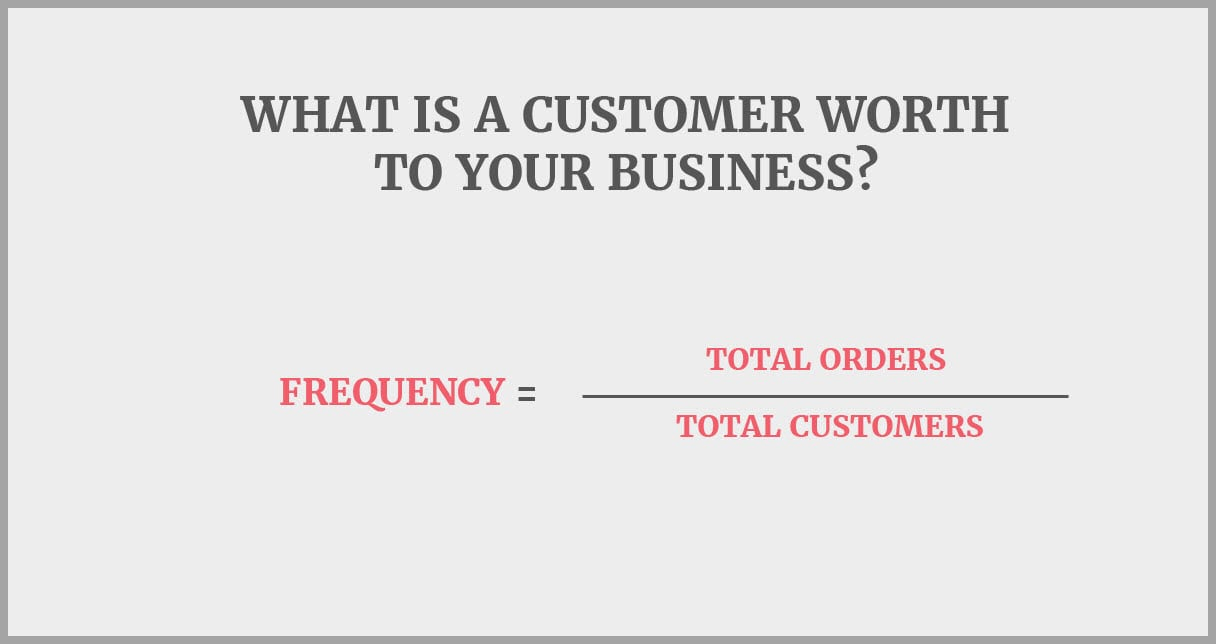

We call this the ‘Purchase Frequency’

To find this out, all you do is:

Total Number Of Sales/ Total Unique Customers…

To be clear- its not revenue that you’re calculating

Its the number of times they buy from you instead

If you know how often they buy, then you have a better idea of how much a customer is worth

So how do you find this out?

Well each payment processor is different but you should be able to find this information on them

If you’re in Paypal, you can find this out by going to reports as before…

Then simply scroll down to number of customers:

This will then show you the total number of sales

Then all you need to do?

Simply divide total sales, by the number of customers

This then gives you an average frequency of how often people buy from you

Easy right?

So lets take the example from last time to help you see this…

Example Sales Frequency:

You made $23,000 over 90 days

This was 113 total sales

We know the AVG sale before expenses was $203.54

For this example, lets say that the expenses were around 40%

So the AVG sale AFTER expenses was $122.00

And so

113 total sales/ 29 unique customers = a purchase frequency of 3.89

That means that most customers would buy almost 4x or more during that time period

Simple right?

We don’t need to get more complex then this

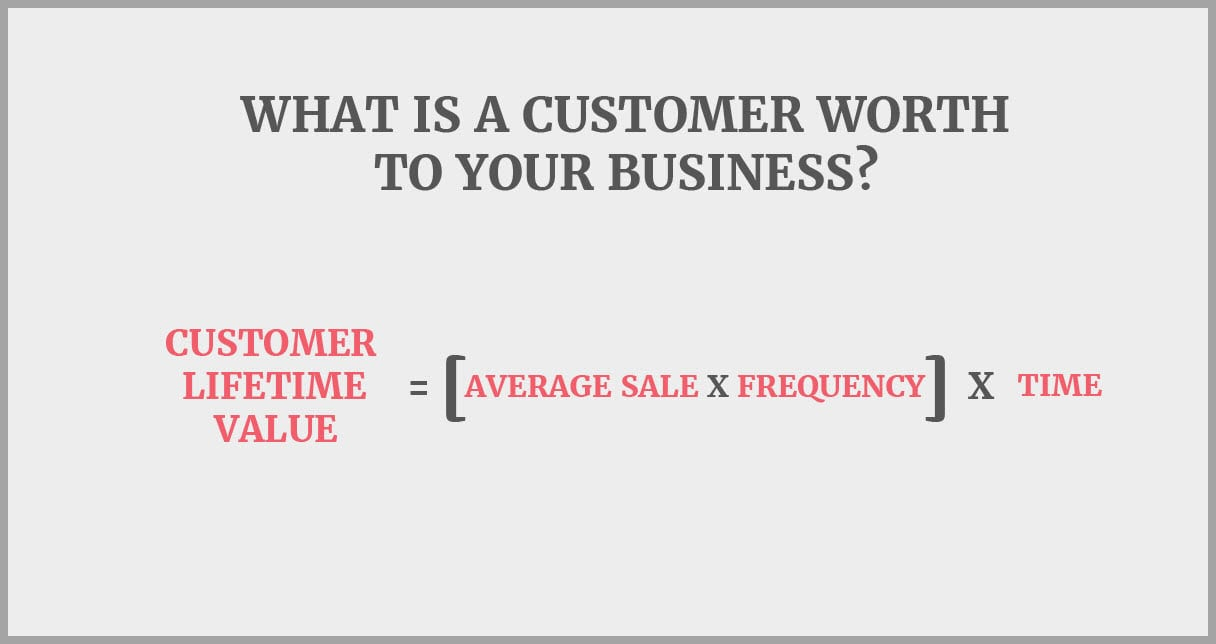

Now that you know the purchase frequency and the adjusted average sale, you can calculate the Customer Lifetime Value

Customer Lifetime Value = AVG Sale x Frequency

So lets use that for the example before

In this example its

$122.12 x 3.89 = $475.06 per person

That’s a much higher figure than the average sale right?

This is what a new customer would actually be worth to your business

Can you see why this is important?

Now that you know what your customer is worth, you can plan your marketing budget…

Step #2: Find Your Marketing Budget

This step is super simple

We’re going to find the maximum amount you should be prepared to spend, to get a new customer

Spoiler alert?

Its 20% of the Customer Lifetime Value that you just found

Now I know what you’re thinking

“Wait, 20% of what they will spend with me in their lifetime?- That’s crazy!”

Not quite

Let me explain…

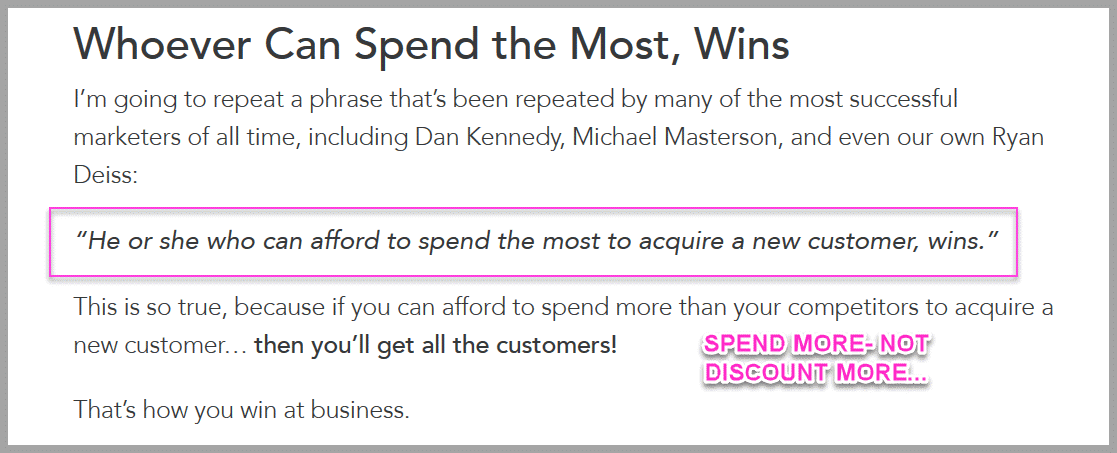

Why You *Should* Be Prepared To Acquire Customers At A Loss(But Aim To Spend Less)

Its competitive out there

You can have the best content and the best product in the world and still fail

Why?

If you can’t pay to get your customers attention, then you’re not going to get sales

So how much should you be spending on ads?

We recommend spending up to 20% of the CLV to acquire a customer

Now to be clear…

That’s the MAXIMUM we recommend to spend

This gives you the one end of your goal posts

As long as you’re not spending more than this, then you know you’re making money

Even better?

With the process you’re about to learn, your ads should outperform that by a large margin

So Why Care About Max CAC?

Because this gives you an edge over your competitors!

How?

It means you can buy a customer at a small loss, knowing you can recoup the costs over their lifetime with you

This is POWERFUL

A lot of businesses don’t do this at all, and its crazy

Rather than spend more on marketing, they discount instead…

But there’s a problem with discounting

Why?

Well not only are discounts usually a higher cost than paying more in marketing…

But even worse?

It teaches your audience to only buy from you when on sale!

Not good right?

But by understanding what you can actually spend to get a customer, it gives you a MAXIMUM range to work with

This means that when your ads are running, you can say

“As long as it doesn’t get past this number, I know the ad is making a profit, over the long term”

Awesome right!

So lets figure out your Max CAC

All you need to do is:

[CLV/100] x 20 = the Max Customer Acquisition Cost

Easy right

This number is the maximum you can afford to spend to get a new customer, while also covering profit and bills etc

So a quick recap

Now you know:

- What a customer is worth to your business, and

- The maximum you can afford to spend to acquire a customer

Pretty awesome right?

It gets better

Now that you know this number, you can use that to start measuring and tracking how well your ads are working…

Step #3: Narrow Down Your Tracking Time

This step is going to save you a LOT of anxiety

We’re going to find out the max you can spend to acquire a lead or subscriber

Why care about this?

Simply put, not every customer will buy from you right away

In our business?

It can take around 30-45 days before someone buys from us…

Why does this matter?

Its because the feedback loop is far too long…

If we only ever tracked sales with out adverts?

It would mean that I wouldn’t see a result on my ads for 45 days or so…

45 days to know if my ad was making or losing money!

Not great right?

This is one of the MAJOR reasons why people fail with paid ads

Why?

Because sitting and waiting while you spend money is a really easy way to doubt your ads…

They tweak, and adjust because they don’t see results

Even worse?

They stop the ad before it has a chance to even make a sale!…

Not great

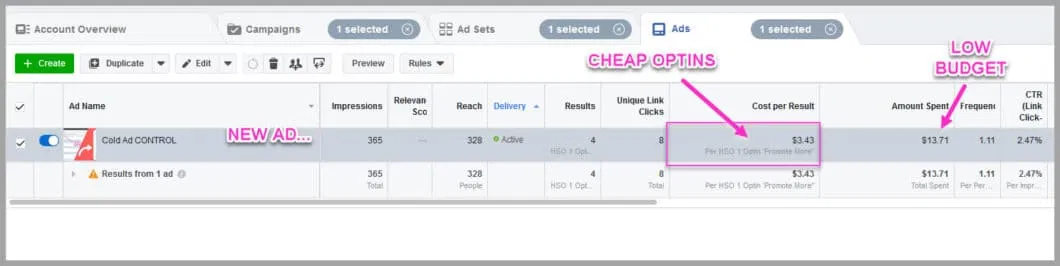

But when you track leads instead?

You can start to see results and feedback in as little as 24 hours…

This gives you an almost immediate feedback loop on how your ad is performing

As long as the lead cost is in limits, then you know the ad is working

Sound good?

All you need to know?

- How many leads does it take you to make a sale (Conversion Rate)

- How much is a lead worth?

The math is real simple

Max Lead Cost = How much a customer is worth/ how many leads required to make a sale

Or

Max Lead Cost = Max CAC/ Conversion Rate of lead to sale

Don’t freak out

Let me walk you through it…

Example:

So we start off by figuring out our conversion rate of subscribers becoming customers

I know that in our business, 1 in 17 subscribers becomes a customer

This is my Conversion Rate from subscriber to customer

This means I need 17 leads on avg before I make a sale

The math is just:

Total leads/Total sales = Conversion Rate

Easy right?

So now you can figure out how much each lead is worth

My MAX CAC is $260.90

So…

Max CAC/ Conversion Rate= Max Lead Cost

In this example?

$260.90/17 leads = $15.34 per lead

That’s the maximum I can afford to spend to get a new subscriber

Boom!

As long as my adverts are getting me subscribers for less than this, then I know its profitable…

Can you see how powerful it is to know this?

You now have a feedback loop of your ads daily performance…

Sure you won’t make a sale right away

But it means that you know without a doubt, that your ads are making or losing money

(Later on I’ll show you how to add this information directly into Facebook, so that it tells you on your dashboard how your ads are performing)

To Do Now:

So there you have it

That’s all the scary math out of the way

The best part?

It’ll only takes about 30 minutes to find these numbers…

Better still?

Not only does it help you know if the ad is profitable?

But it also helps you understand just how much you need to be spending to make a sale

How?

Well in this example I know that I need at least 17 leads before I make a sale

If I stopped the advert before then?

Then chances are high I wouldn’t make a sale or see a return on my marketing

(Most people stop their adverts before they ever have the chance to convert)

But by knowing these numbers, you know if the ad is profitable AND how much you should be prepared to spend

Can you see how powerful it is to know your ROAS?

Right now you know:

- What a customer is worth (CLV)

- What you can afford to spend to acquire them (CAC)

- What you can afford to spend to acquire a lead (CAL)

- And how much you should be prepared to spend before you’ll see a sale

Heck…

You even know how effective your content is at converting your audience

Great job so far!

(This was the hardest part of this guide, and I promise there are far less acronyms as we go on)

Now you know what to aim for, and what you can spend, its time to start planning your new ad

If you’ve never written or designed an advert before, don’t worry

We’re going to walk you through it all, right from the beginning…

|

|

|---|---|

|

|

|

|

|

|